2014. What to expect in the new season?

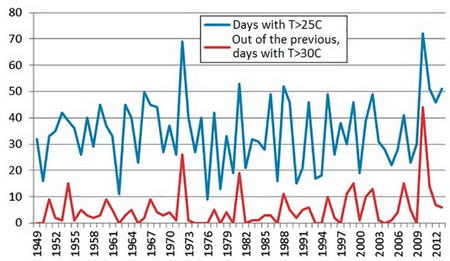

2013 was a strange year. If follow the usual logic of the strict connection between weather and sales, is rather difficult to explain the behavior of AC market that year. For example, in the north of the European part of the country the summer was warm (Diagram 1). As to May, it was the hottest in the last 30 years. The temperature exceeded the norm by 3,7 ° C, that is equivalent to moving Moscow into the climatic zone of Rostov-on-Don. The hotter weather was registered only ones in the history of meteorological observations in 1979. And the «Hot Wave» happened just in time, from May 9 to 20, when the daytime temperature of 12 consecutive days did not fall below 25°C. The previous years, similar beginning of the season always provoked a sharp increase in demand and caused days-long queues for the installation of equipment and lack of popular models. In 2013, there was nothing like this. And if the absence of deficit can be attributed to the huge inventories, the nature of the May sales deserves special attention. They were higher than in 2012 and 2010, but the demand was smooth, grew gradually and stabilized at a comfortable level for the sellers without leaps. Then, the demand went down also gradually despite the warm (by 2,8°C above normal) June. In July, which turned out to be within the climatic norm, sales were significantly lower than in the previous years. As a result, in the central Russia and the Volga region sales fell by 16%, in the Moscow city by 8%. At the same time, in the south where the summer was cool the fall in demand was only 3%.

Source: Litvinchuk Marketing

How can be explained such behavior of the market? To answer this question, we must understand the behavior of sated and unsated market. If for example, 25-50% of those who are able and willing to buy air conditioner have already had it, the heat will certainly provoke a surge of activity. In 3-4 days after the beginning of warm weather, the number of buyers grows like an avalanche, and when the temperature falls it falls as sharp. Something alike was observed, for example, in 2009. If the market is 80% sated, for example, the heat wave makes people just to switch on their air conditioners, and increased flow of those who do not have air conditioners can not make a stir already.

The weather anomalies influence a sated market much weaker than the growing one. Take, for example, Japan. Sales in the Land of the Rising Sun for many years fluctuated around the mark of 7.8-8.5 million air conditioners. In other words, the reaction of the well formed market to heat or cold is around ± 5%, and seasonality of the sales is also smoothed. If the primary demand happens mainly in the hot weather, the replacement of equipment often occurs immediately after its break.

In 2013, the Russian market hinted with its behavior that the number of air conditioners in the country is close to saturation. This fact may seem surprising, but let’s analyze it in detail.

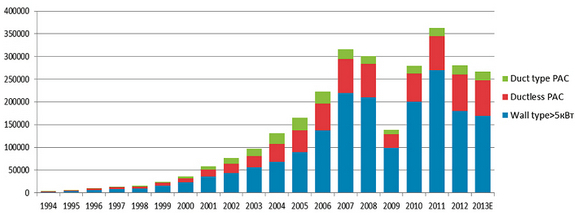

If we recall the evolution of the market, we would see that at the first stage mainly the commercial segment was developed. Massive sales of room air conditioners began only in 2002. Therefore it is logical to assume that the commercial segment should be sated the first. I believe no one doubts the fact that air conditioners of 5 kW and more rarely get into the housing. So, the sales of PAC Wall type AC of more than 5 kW well reflect the dynamics of the commercial segment (the splits <5 kW can be divided into commercial and residential segment only with a certain degree of confidence). Market dynamics of PAC + Wall type> 5 kW market is demonstrated at Diagram 2.

Source: Litvinchuk Marketing

So, what do we see?

Even a fleeting glance is enough to notice the trend of 2007-2013: slow shrinkage of the market with the average rate of 2.7% per year. That is, there is a stabilization of the segment, and in recent years a substantial part of the sales was caused by replacement. Given that the sales of air conditioners for the housing application began to develop with about 5-7 years delay with respect to the commercial segment, in 2012-2014 the sales stabilization can be expected. Indeed, „the housing segment“ which now accounts for about 80% of sales has changed dramatically in recent years. Rich compatriots, who formed the demand in the early and mid-2000s, by the end of the decade, gave way to the middle class, which for the most part got sated with air conditioners by the end of 2011. The last 2 years the middle class was replaced by fellow citizens with income below average: mostly well-paid state employees such as policemen, military, low-level bureaucrats. On the one hand, the last couple of years, their wages rose significantly; on the other hand, the minimum price of room air-conditioners in the stores plummeted thanks to the huge remains of unsold equipment. In 2013, ordinary RAC could be bought for 6000-8000 rubles, while prior to mid-2011 it was not cheaper than 11 000-12 000 rubles.

As a result, demand quite naturally shifted to the economic segment. In 2013, the Chinese air conditioner brands and OEM-brands made in the China factories made about 70% of sales. Moreover, 40% of the market occupied „cheap China“, that is a split system, not manufactured in the „big three» factories: Midea, Gree, Haier.

There is very remarkable fact: sales of Japanese inverters are stable. That is, the sales of air conditioners for luxury housing (this segment was formed the second after commercial) are not getting down, and are substantially caused, especially in the south of the country, by the need to replace the installed earlier equipment.

In order to prove the hypothesis of the high saturation of the market, let’s compare sales in the certain regions of the Russian Federation with sales in those countries of Europe, where the markets are sated (dynamics less than 5% per year). Summer in the Central part of Russia is comparable to summer in Germany, Great Britain, Holland, the Czech Republic and Austria. Summer in the South of the country is alike the summer in the Southern Europe. Let’s calculate the number of air conditioners using the simplified formula. Take the average for 9 years (2005-2013) volume sales in units, multiply it by the life cycle of the air conditioner (assume it to be 9 years for Northern Europe and 6 years for the South) and divide the resulting figure by the number of population. So, what do we see from Tables 1-2?

Table 1: Comparison of market saturation (Northern Europe — Middle Russia)

| Country (Region) | Population (million people) | Sales (units) | Average annual market growth (2005-2013 Å, %) | Annual sales (average for 2005 – 2013) | Number of AC (units per1000 people) | |

|---|---|---|---|---|---|---|

| 2005 | 2013E | |||||

| Germany | 80,2 | 296880 | 340600 | 1,7 | 350377 | 39,3 |

| Great Britain | 63,2 | 361194 | 251000 | -4,4 | 299940 | 42,7 |

| Holland | 16,8 | 75485 | 60300 | -2,8 | 68564 | 36,7 |

| Czech Republic | 10,5 | 46155 | 47100 | 0,3 | 46395 | 39,8 |

| Austria | 8,4 | 38828 | 44 300 | 1,7 | 40255 | 43,1 |

| North and Middle Europe | 179,1 | 818542 | 743300 | -1,2 | 805531 | 40,5 |

| Volga Region | 29,2 | 81000 | 163000 | 9,1 | 151200 | 46,6 |

| Center (without Moscow) | 22,3 | 27600 | 68000 | 11,9 | 55122 | 22,2 |

| Siberia | 21,0 | 38900 | 85000 | 10,3 | 56956 | 24,4 |

| Urals | 15,6 | 43100 | 88000 | 9,3 | 62900 | 36,3 |

| North-West | 14,7 | 36500 | 83000 | 10,8 | 65744 | 40,3 |

| Middle Russia | 102,8 | 227100 | 487000 | 10,0 | 391922 | 34,3 |

Source of data: BSRIA, Litvinchuk Marketing(Russia)

At the moment, the market saturation (number of air conditioners per 1,000 people) in Russia in comparison with European countries is 84.8% = 34.3 / 40.5 for the Middle region and 86.0% = 129.6 / 150.6 for the South. Practically, the same figure!

The income level in Europe is significantly higher than in the RF. If we consider that in 2003-2005 sales in the European countries (especially in the South of the Continent) significantly exceeded the figures of 2013, we can expect some reduction of the market in the Russian Federation in the coming years.

Turkey may good be for comparison. In 2013, the average salary there was equal to 26,930 rubles, that is almost equal to the average salary in Rostov-on-Don: 27 662 rubles. Market saturation in hotter Turkey occurred with the AC number of 93 air conditioners per 1,000 people, or 71% of what we can already see in the South of Russia (Table 2).

Table 2: Comparison of market saturation (Northern Europe — Middle Russia)

| Country (Region) | Population (million people) | Sales (units) | Annual average market growth (2005-2013 Å, %) | Annual sales (average for 2005 – 2013) | Number of AC (units per1000 people) | |

|---|---|---|---|---|---|---|

| 2005 | 2013E | |||||

| Italy | 59,6 | 2421189 | 1192552 | -8,5 | 1634735 | 164,6 |

| Spain | 47,1 | 1743842 | 635470 | -11,9 | 1000717 | 127,5 |

| Greece | 10,8 | 382251 | 365855 | -0,5 | 314252 | 174,6 |

| Southern Europe | 117,5 | 4547282 | 2193877 | -8,7 | 2949705 | 150,6 |

| Southern Russia | 24 | 263700 | 650000 | 12,6 | 518244 | 129,6 |

| Turkey | 75,7 | 1144830 | 1363599 | 2,2 | 1172866 | 93,0 |

Source of data: BSRIA, Litvinchuk Marketing(Russia)

So, we can say that with the present level of life, the air conditioner market in Russia is close to saturation. In the near future we can expect some decline in sales, followed by stabilization of the market. And later on the growth of about 5% per year.

Georgy Lytvynchuk