Hazy prospects

End of 2014 turned out to be difficult for both Russian climate industry and the country. Collapse of the rouble and sharp decline in the purchasing power of population suggest gloomy thoughts about the upcoming season. How to assess the prospects of the market for 2015? What could we compare the today situation with?

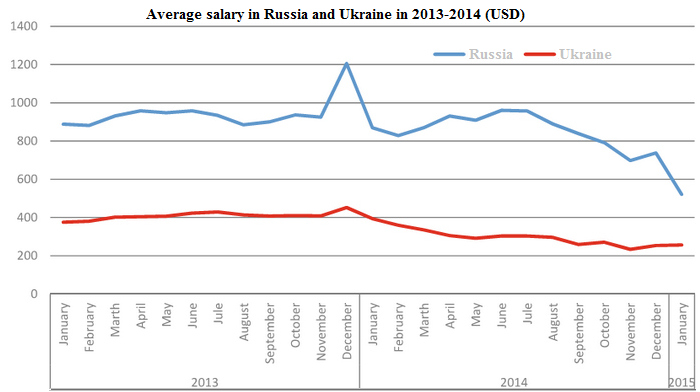

The first thing that comes to mind is Ukraine of the last year. Fall of the national currency, crisis and uncertainty. Let’s have a look what happened with the personal income expressed in USD (price of air-conditioners is usually pegged to USD exchange rate) in these two countries. The diagram clearly shows that in Ukraine the income was falling down quite smoothly and, in fact, it happened when the season (February-April) already started. At the same time, the situation was stable enough from April to August. As compared to the year 2013, the income DROP ped during the 2014 season by 25%, or approximately from USD 400 to USD 300. In autumn the income DROP continued, but the season already ended. In 2014, the Ukrainian market was estimated at 220,000 air conditioners. A year earlier the market was of around 480,000, of which about 77,000 were the sales in Donetsk and Luhansk, where in 2014 nobody bought air conditioners for obvious reasons. By the way, deliveries to Crimea came from Ukraine up to November, 2014.

Thus, when assessing the fall of the Ukrainian market it would be correct not to take into account the sales in Donetsk and Lugansk. In this case, the fall was 45% (from 403,000 to 220,000 units).

Diagram 1

|

| Sources: Rosstat, Derzshkomstat |

If we take Russia, the personal income DROP in USD terms was much more substantial. If in the season of 2013 the income level was about USD 935, by January 2015 it DROP ped to USD520. However, there is some hope that the seemed trend towards higher price in the oil market would allow the rouble (and also the purchasing power) to recover a little bit. So, as compared to the Ukrainian market, by now we see that on the one hand the DROP in personal income in our neighboring country was much milder. On the other hand, it happened not before the season but actually during it. And the nominal income in Russia is still twice as high.

Thus, the „Ukrainian variant“ of the course of events can be considered as the worst. It could happen in case of a further deepening of the crisis and continuing fall in oil price.

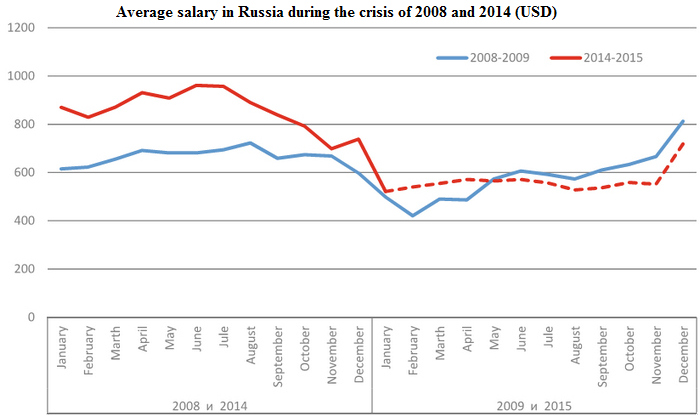

Let’s try to compare the today situation with the Russian crisis of 2008. (Income in 2015 is a forecast).

Diagram 2

|

| Sources: Rosstat |

We see a similar change in the income of population. The distinction is that in the first case the bottom was reached in February, and now, let’s hope, in January. Percentage of the DROP to the lowest point is comparable with the previous season: in 2009 — 39%, in 2015 — 45% by now. Income forecast for the summer 2015 practically coincides with the figures of 2009.

So, what is the difference between 2015 and 2009?

First, by 2009, the corporate sector the market continued to develop. It reached a peak in 2007 and since then for almost 7 years remained at the same level. It was despite the actual stop in construction of the offices of class „C“ and sharp slowdown in the development of small business: small shops, cafes, hairdressers. This means that reduction in a number of new customers was compensated by growing demand for replacement of old equipment. No wonder, sales to the corporative sector started in 1995.

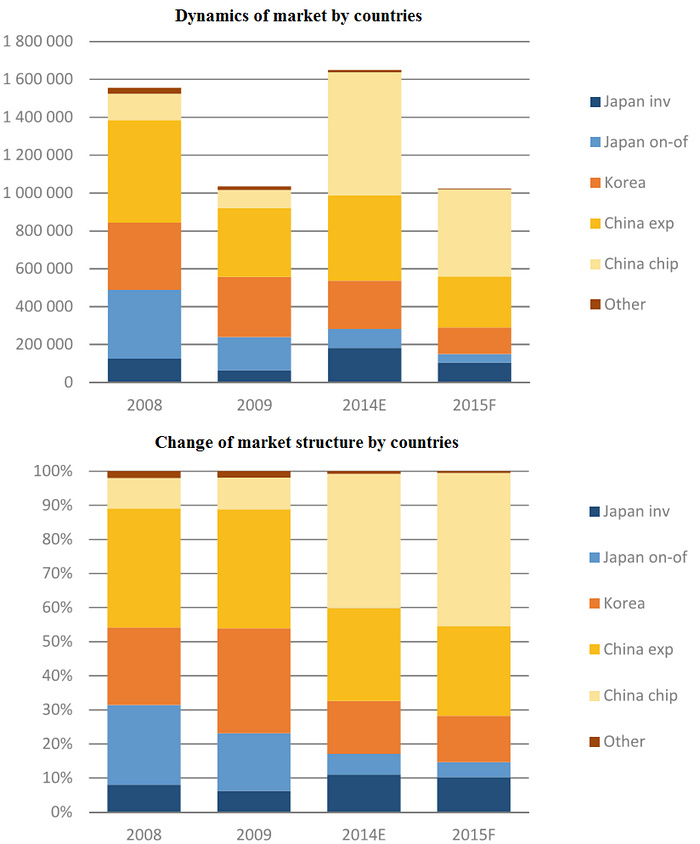

Thus, if in 2009 the market of corporate sales seriously fell down, then in 2015 it would suffer much less DROP. Climate equipment in the office became a routine, and in case of break-down of equipment it would be necessarily changed for a new. Another thing is that more cheap option could be chosen. For example, on the PAC market active replacement of equipment is under way, and Japanese air-conditioners are quite often replaced with more affordable Chinese models.

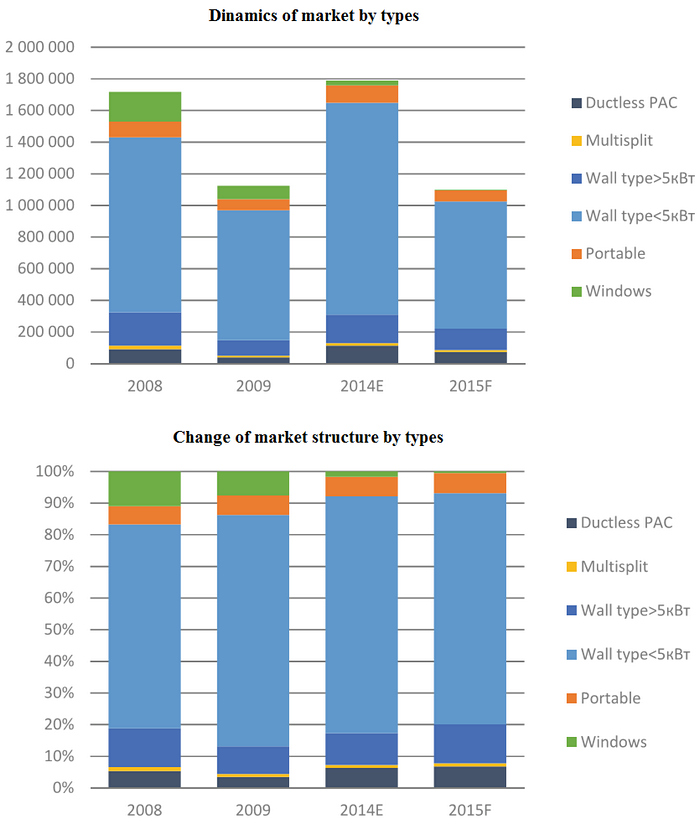

As far as private clients are concerned, the situation is distinctly different from 2009. In 2008, room air conditioners were bought mostly by wealthy and middle class people. That time it was they who made the majority of buyers of the first in life air conditioner. In 2014 the situation was completely different. The bulk of middle class people already purchased AC in 2005-2011. Since 2012, the main drivers of the market were ordinary officials of government organizations and retirees. On the one hand, their salaries and pensions were seriously raised; on the other, the lowest price for air conditioner with installation fell from 15,000 in 2010 to 10,000 roubles in 2014 in some regions. It is clear that this year there will not be so low prices, and this category of buyers is out of the game. In practice this means a one-time loss of at least 30% of sales in terms of units and 18% in money terms. These customers buy only low capacity models of „super-economic“ group. Thus, the crisis of 2015 will differ: there will be significantly smaller decline on the markets of PAC and wall air conditioners with capacity over 5kW and sharper fall of room segment. Moreover, if the share of cheap equipment in general would grow, the „super-economic“ segment, largely represented by anonymous products of unknown origin, may suffer. Its target group practically leaves the market, and middle class will have to get back to reality and try to find branded equipment or hyped-up OEM at a lower price. So, the Internet sales will have further development, while the share of retail chains may DROP as in 2014.

It should be noted that in 2015 the replacement of overaged equipment will give at least 40% of sales. The scale of the phenomenon can be estimated based on the volume of sales in 2000-2004: average 430,000 units of which 310,000 were split systems. Many owners of window monoblocks replace them with cheap split-systems. Summarizing, we can assume that the market would fall by about 40% to 1,025,000 splits. The market decline in the money terms would be slightly less, but the margin level would be low. A more detailed forecast is shown at the Diagrams 3 and 4.

Diagram 3

|

| Sources: Litvinchuk Marketing |

Diagram 4

|

| Sources: Litvinchuk Marketing |

Georgy Litvinchuk,

General Director of Agency Litvinchuk marketing