A Review of the 2010 Global AC Market

Introduction

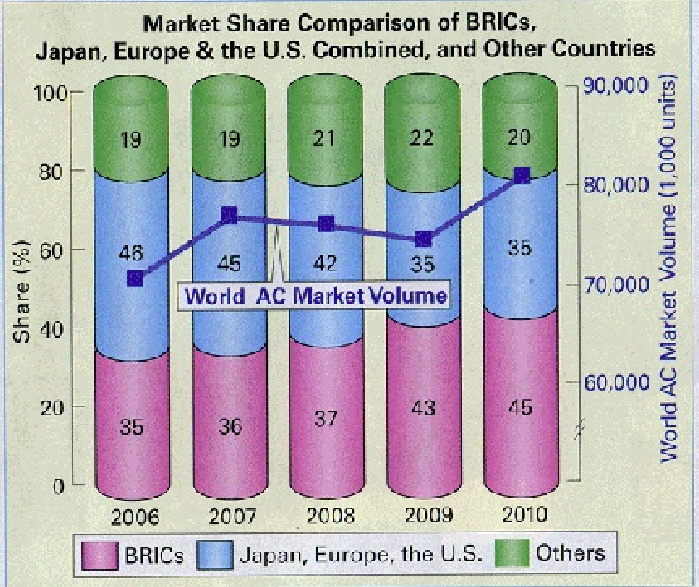

The world economic is recovering. Strong growth is observed in emerging economies, particularly China and India, which stimulates consumer demand for air conditioners. Another driver of the global AC market is extremely hot summer weather. JARN estimates that the total global air conditioner market (RAC and PAC) in 2010 was 81.06 million units, a year-on-year increase of 9.6%. Of this, the Chinese and Indian markets both posted growth, with the former expanding to around 29.8 million units and the latter expanding to 3.4 million units.

The successful measures taken to encourage purchases of home appliances in Chinese rural areas caused further expand of its air conditioner market. It is noteworthy that the share of inverter units in China has also increased significantly over the past year.

The Asian region as a whole grew by around 20%. Domestic consumption in many Southeast Asian countries, including Thailand, Indonesia, Malaysia, and Vietnam, out-paced that of 2009. A few countries could not keep pace with the additional demand at their power grids. PAC demand rises in Indonesia and Malaysia, where facilities investment is growing. Living standards in India are rising in conjunction with economic growth, spurring expansion of the RAC market. The PAC market is also experiencing growth due to heavy investment in commercial and retail facilities.

The Brazilian economy is in the spotlight. Preparations for the upcoming 2014 FIFA World Cup and 2016 Olympic Games in Rio de Janeiro became a significant driver for increase of purchasing power.

Recovery can be seen in the North America. The large market in the northeast of the United States and Canada experienced a particularly hot summer, which drove up demand for residential mini splits. Inventories of window units left over from 2009 were largely sold off. However, some reports are indicating a DROP in demand for commercial systems.

Due to economic circumstances in some EU countries, the European air conditioner market is in less than ideal shape. Meanwhile, demand for small units, particularly inverter units, was up in France. PAC demand increased in Germany. Record-high summer temperatures breathed new life into the Russian market, where demand soared. Economic recovery also helped expand demand for PAC and accelerated the switch from R22 to R410A.

Due in part to hotter-than-average summer temperatures and government EcoPoint incentives, the Japanese air conditioner market expanded nearly 17% in calendar 2010 to a level of 8 million units.

Now let us take a look back at the global air conditioner market.

China

The sweltering heat coupled with increasing purchasing power in China kept the air conditioner market expanding at a brisk pace.

Non-inverter air conditioners with an energy efficiency grade of 1 or 2 in the country's new energy-efficiency labeling scheme accounted for 90% of sales in urban areas. The ratio of inverter air conditioners in use in medium- and large-size cities topped 25% showing an increase of 10% over 2008.

In April 2010, China issued the State Council Decree on Regulation on Management of Ozone Depleting Substances. It went into effect on June 1, 2010. This decree states that production and use of R22 will be frozen at 2009–2010 levels in 2013, and then phased down by 10% in 2015, 35% in 2020, and 61.5% in 2025, and completely phased out by 2030.

Exports of air conditioners grew as compared to 2009 and surpassed pre-crisis levels. Large increases in exports to Southeast Asia and Latin America were seen in particular. All in all from August 2009 to July 2010 exports to Latin America reached approximately 6.7 million units. Brazil, Argentina, and Mexico are the biggest importers. China’s exports to Africa increased from 190,000 units in January to 388,400 units in June, equivalent to year-on-year increases of 38% and 134.6%, respectively.

Strong internal and external demand caused Chinese manufacturers, including Gree, Midea, Haier, TCL, and Hisense-Keion, to increase production. To move production closer to local markets, Gree, Midea, and TCL opened assembly lines in the Middle East and Africa.

The United States

Many areas of the densely populated East Coast, West Coast, and Northeastern United States set new high temperature records in June. Inventories of window units left over from the previous year were largely sold off. Shipments of window units do not appear to have grown significantly, with estimates in the range of 6.5 million units, a year-on-year increase of 4%.

The U.S. housing market has not yet recovered, which has caused limited growth of demand for unitary systems. While new unitary systems adopt R41QA, older units outfitted with R22 and popular with customers are still in stock. The U.S. unitary market is dominated by Carrier, Trane, York (JCI), Goodman, and Lennox.

Thanks to a tax credit, the room split market showed improvements. While in 2009 sales of splits were down due to the recession, in 2010, they returned to 2008 levels. However, splits still represent only a tiny fraction of the U.S. market, but there is hope for their spreading. The leader is Mitsubishi Electric, followed by Fujitsu General, Sanyo, and LG. Carrier has announced plans to sell split air conditioners under the Toshiba Carrier brand, while Panasonic is planning to sell models using Sanyo's sales channels. Daikin is focusing its energies on VRF systems, which were are gaining recognition in North America.

The requirements to earn the Energy Star label have been updated as of January 1, 2011. To receive the label, new products must be tested at an Environmental Protection Agency (EPA)—authorized testing facility.

India

India’s economic growth and massive market potential have attracted a large number of overseas manufacturers. In 2010, India's air conditioning demand was 3.4 million units, an increase of about 30% over the previous year. Window units dominated the market until about two years ago, but over the last year sales of mini splits overtook those of window units.

Inverters are rare: constant-speed units make up 99% of the market. R22 is the main refrigerant. The Indian market is more sensitive to price than function, and high-priced units in general do not sell. Most local manufacturers are assemblers targeting the low-priced segment. They hold a 40% share of the mini split market.

With new production facilities built in India, South Korean manufacturers got to the market ahead of Japanese competitors. Japanese manufacturers, hoping to take back some of the low- and mid- end segment, are working to develop units specially designed for local needs and build up their sales networks. Most Japanese manufacturers are still importing their air conditioners from Thailand, Malaysian, and Chinese. And only Hitachi is producing window units and splits, and Daikin VRV systems in India. Both companies have started local production of screw chillers last year.

Southeast Asia

Southeast Asia also experienced sweltering summer temperatures that caused RAC shipments to soar in Thailand, Vietnam, and Indonesia in particular.

Upgrading power infrastructure is a pressing issue in many Southeast Asian countries, which has a serious impact on the scale and structure of the air conditioning market. For example, power to residential homes is rationed in urban areas of Vietnam, which has boosted sales of small air conditioners.

In the region, attempts are made to develop minimum efficiency performance standards (MEPS) and mandatory energy labeling schemes.

Most countries are implementing phase-down schedules for R22. While the proportion of R22 units still in the market is high, some countries are contemplating restrictions on new installations of R22 units.

With a market scale of 1.27 million units, Indonesia is the largest market in Southeast Asia. South Korean and Chinese manufacturers lead the market, which is primarily comprised of non-inverter cooling-only units. Of Japanese manufacturers, Panasonic has the strongest foothold in the region.

Thailand's market scale is on the level of 900,000 units. Mitsubishi Electric holds the lion's share of the market, followed by Daikin, Panasonic, Toshiba, Sanyo, LG, and Samsung. Mitsubishi Electric, Daikin, Toshiba Carrier, Fujitsu General, MHI, Sharp, LG, Samsung, and Haier are engaged in local production intended for domestic consumption.

Brazil and Argentina

Brazil emerged from the global recession quickly. Brazil's air conditioner market tilts toward inexpensive cooling-only units. Brazil was formerly dominated by window units. Recently, however, splits are making inroads, sales of which grew by 30% in 2010 to top 1 million units. Window units recorded sales of 700,000, largely unchanged from 2009. The VRF market posted sales of 4,000 systems.

Springer Carrier is the leading local manufacturer. Most mini splits sold in the country are manufactured in China. Hitachi and Fujitsu General have established their own sales companies in Brazil. Hitachi also has a factory in Sao Paulo and has been in the Brazilian market for over 40 years, mainly selling splits, VRF systems, and chillers. Fujitsu General has a sales base in Sao Paulo and sells high-end inverter air conditioners. It also plans to start selling multi splits in Brazil and introduce VRF systems.

Panasonic, which moved its Latin American head office from Florida to Sao Paulo in 2009, sells a lineup of eight inverter air conditioners capable of cooling and heating.

Mitsubishi Electric is using local distributors and expands sales of its air conditioners, mainly multi splits and VRF systems.

Argentina is the second largest market in South America. In 2010, its split market was 450,000 units. Import tariffs are high, so finished products are at a serious disadvantage in the market. However, products that are assembled on Tierra del Fuego and then sent to the Argentine mainland are exempted from the VAT. Companies engaged in assembly buy parts from China and sell the products under a dozen different brands. As a result, over 90% of air conditioners in the market are assembled domestically by local manufacturers.

Expert opinion

In the summer of 2010, heat covered the center of the European Russia. There were 44 days with temperature higher than 30 °C and 33 of them made one continuous hot wave! Is it much or not? To answer this question you should know that during previous 60 years there were only 260 days with temperature from 30 °C, that is 4.4 hot days a year. As a result, sales of domestic split systems almost doubled, reaching 1,825,000 pcs. Besides, 77,000 of window and mobile ACs were sold. Therefore, RAC/PAC market capacity exceeded 1.9 mln pcs, which made Russia the first in Europe and the fifth in the world, after China, USA, Japan and India. Though, this growth was mainly due to the sales of economy ACs (75 % of sales volume) with the capacity of 2-3.5 KW (91 %). So, the results of 2010 let us state that the situation in Russia is rather typical for southern countries. As for PAC, VRF and wall-type systems >5 KW, their sales had never reached the pre-crisis level as the main share of sales growth was due to individual customers’ purchasing ACs for their households.

When it comes to the outlook for 2011, we should take into account that more than 1.1 mln of ACs were sold in Moscow in 2010. So, expecting further sales increase in Moscow after 2.4X boost of the last year would be rather thoughtless. Inevitable market growth in regions will not be able to set off the expected sales DROP in the capital of Russia. In addition to it, critical shortage of split systems of 2–3.5 KW holds in check the sales in the beginning of 2011 season. As of the middle of April, unsatisfied demand reached 200,000–300,000 units. We should not expect that this equipment would be needed in the tepid summer.

Nevertheless, at the year–end of 2011, Russia will definitely have kept the gained positions. Only in January–March, approximately 750,000 RAC/PACs were sold in Russia, which is the all-time record for the low season. In April–June, the stock being sufficient, monthly sales are expected to reach 300,000 ACs followed by slump in sales afterwards.

Georgy Litvinchuk

Europe

Economic recovery in Europe is taking longer than expected. Spain and Greece are still feeling the effects of the economic crisis, while the economies of Germany and to a lesser extent France and the UK are looking up. The hot weather from the end of May to the end of July 2010 led to increase in AC sales in Europe. France saw sales grow about 40% over the previous year. The German market also witnessed solid expansion.

Sales in Russia fell dramatically in 2009, but staged a strong comeback in 2010. Russia could even become Europe's largest market in the future. In the near term, Russia is set to roll out energy- efficiency regulations and ban R22. LG leads the market, followed by Panasonic, Daikin, and Samsung, who are all growing their business in the country.

Middle East

In the UAE, air conditioner demand was strong three to four years ago during the construction boom. But after the Dubai debt shock of November 2009, construction projects were halted, credit dried up, and many contractors who could not procure funding went under. It will likely be another two or three years before the region fully recovers.

Including Egypt, the Middle Eastern air conditioner market has a scale of 4.5 to 4.6 million units. Growth was relatively flat last year. Saudi Arabia is the largest market with a scale of about 1.5 million units, most of which are locally produced. The UAE is the second largest market with about 800,000 units. Iran is third.

LG operates a production factory in Saudi Arabia and has an influential presence in the Middle Eastern region. Chinese manufacturers are also aggressively moving into the Middle East and buying up local companies. For example, Midea purchased a 32.5% stake in Egypt's Miraco.

Other Regions

Australia fared relatively well in the global recession, and its economy in 2010 was on par with performance in 2009, amounting to approximately 850,000 units.

Total air conditioner exports from China to Africa increased by more than 100% from January to August 2010. LG, Midea, and Gree lead exports to Africa. Following in the footsteps of South Korean manufacturers, Chinese companies are also setting up production bases in Africa and looking to expand their market share.

Postscript

As the global air conditioning market expands, problems related to environmental issues and power shortages are cropping up in different regions. As a result, MEPS and refrigerant restrictions are being enacted or strengthened in countries. Refrigeration and air conditioning equipment has a significant role to play in preventing global warming, and the HVAC&R industry has a responsibility to continue improving the environmental sustainability of its products and services and conduct activities from an international perspective. As part of this, the use of natural refrigerants, including CO2, ammonia, and hydrocarbons, is expanding. Research and development on applications for new low-GWP ozone-friendly refrigerants is also gaining momentum.

In the global market, the sizable low-end segment in emerging markets is the most attractive. The trend of localizing production will likely give rise to new production facilities being established, particularly in emerging markets.

Away from the low end of the market, the solutions business is receiving the most intense focus. These solutions encompass home energy management systems (HEMS) and building energy management systems (BEMS).

In 2010, the global economy did not recover as much as initially projected. We can only hope the summer of 2011 will be more optimistic.

Based on JARN materials