Russian market of chillers

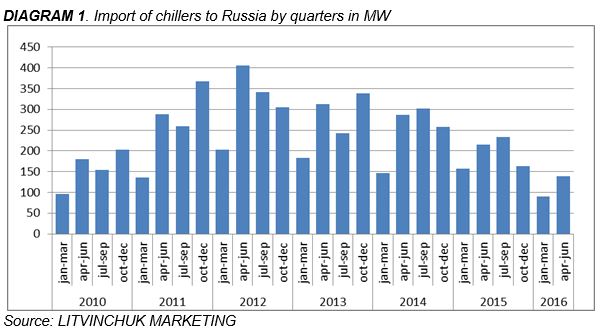

In the first half of 2016, the Russian market of chillers continued to drop. As it can be clearly seen at the Diagram 1, imports fell down by more than 1.5 times in the first half of 2016. At the same time, domestic production increased.

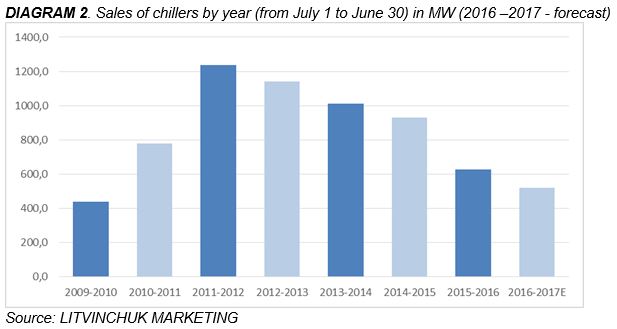

In order to see more clearly the dynamics of the market (taking into account the last six months), let’s have a look at it with the annual intervals that end on June 30 instead of December 31.

It can be clearly seen that the sales decreased by 32% over the previous year. In the absolute terms, this is less than a half as compared to the peaks of the years 2011 and 2012. More o less the same trend can be seen on the other markets of the industrial air conditioning systems, for example, the markets of VRF and AHU.

If predicting the near future, it is expected the slow down of the drop and gradual stabilization in 2017. In the second and third quarters of 2016, the construction works were resumed over a number of large projects which were started in

The economic situation remains difficult, but in the

About such development of events say also the dynamics of the VRF market. At this market, the lag between the announcement of tender and the supply of equipment is significantly shorter. In 2016, this market demonstrated a weak negative trend according to the results of 8 months (-14%), whereas the results of the first 4 months were −20%. This indicates that the final figures for the chillers will be somewhat better than the figures of first half of the year.

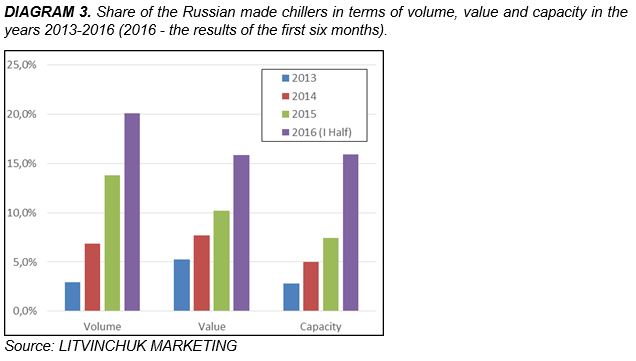

In the public sector, dominates the trend to replace imported equipment by the Russian analogues, if any. This trend is enshrined by law in the new edition of the Federal Law on Public Procurement. Since January 1, 2017, at the public procurement tenders the Russian equipment will win even if it has a 15% higher price in comparison with the foreign analogs. Given that Russian equipment is now around

At the same time, the share of Russian products grew rapidly even without these measures, as it can be seen at the Diagram 3. Chillers in Russia are produced successfully for a long time by such companies as Thermocool, Aerocond and Teplosibmash, but the scale of production did not exceed

Taking into consideration the growth in number and quality of production sites, as well as the fact that 90% of low-temperature cooling machines are manufactured in Russia, we can expect further growth of the share of domestic manufacturers. The preferences for participation in the public procurement will also accelerate this process.

In 2017, it can be expected the increase of the share of Russian made chillers up to

This forecast can be safely done in view of the fact that the public procurement is at least 15% of the total consumption of the equipment, and 40%-45% more is the purchasing of the state-owned companies. As practice shows, they follow the government policy in their procurement practice.

So, in the nearest

In this article were used the materials of APIC and the company LITVINCHUK MARKETING