Year 2016. Hot and complex

Despite the nice warm summer, the season 2016 was not easy for HVAC industry. Heat wave mercilessly swept a number of regions of the country, of course, prompted people to buy air conditioners (or to replace the old ones). But in monetary terms, sales were below the level of 2009.

Georgy Litvinchuk,

General Director of Litvinchuk Marketing

Many Russians are sure that the summer, 2016 was one of the warmest in the recent years. Indeed, in Moscow, the biggest HVAC market, the average daily temperature was in line with the top ten hottest summers from the start of meteorological observations, dividing 7-8 places with the year 1981. Summer was hotter only in 2010, 1972, 2011, 1938, 1936 and 1999. The long-term rate of average daily temperatures for the three summer months (17,7 îÑ) was exceeded by 1.9 degrees, that is equal to the "move" of Moscow to the latitude of the town of Voronezh.

At the same time, there were only ... five days with temperature higher than + 30°C. That is, speaking the common language, the summer was not so hot but uniformly warm. The only period of long heat, when the temperature was steadily kept above 25°C, lasted from July 25 till August 11. Because the heat came late, it caused not so much a wave of spontaneous purchases, but the renewal of worn-out air conditioners which did not cope with the two week long load.

Days with T>25C

Including days with T>30C

Night temperatures (in 00-00, when the majority of compatriots goes to bed) even in these hot days were not so impressive: average 18,8 îÑ, maximum 21,6 îÑ, that is, were quite comfortable for sleeping range.

Looking at Diagram 1, which reflects the statistics of warm days for Moscow, it can be said that the concept of the norm for the Russian capital changed dramatically after the memorable 2010. If the number of days with the temperature above +30°C remained the same, the number of days with the temperature higher than +25°C was significantly bigger: according to this indicator, 5 of the last 6 years were warm. It is just the time to revise the criteria of assessment of a particular summer.

Two sides of the same coin

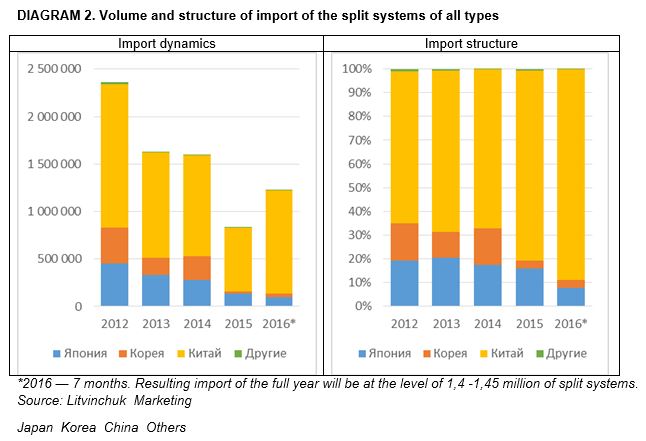

As it can be clearly seen at the Diagram 2, season 2015 was marked by a record low volume of imports of split systems. The reason for it were the huge inventories accumulated in warehouses at the end of the season 2014: about 880,000 units with a projected demand at the level of 1,2-1,25 million units. In this situation, Russian distributors were extremely cautiously when purchasing the equipment.

As a result, this tactic paid off. Inventories decreased during the year to 495,000 units, what is quite acceptable. Many leading suppliers had almost no inventories, while the inventories of a number of importers remained still big.

Such a drastic reduction in consumption at one of the most important markets could not remain unnoticed for the Chinese manufacturers. Manufacturers from China react to such signals quite predictably: decreasing the selling prices. There were at least two factors more which pushed them to doing it: huge inventories in China and depreciation of yuan against dollar. Anyway, in the season 2016, the prices for Chinese products fell down on average by 17% in dollar terms, for some individual items even by 20-22%.

It could seem that such a step had to please the suppliers, but in fact it seriously complicated the situation of many distributors. First of all, those who had inventories of the season 2015 significantly higher than the optimal. The matter is that the profitability of the climate business fell down sharply in the past 2-3 years and now does not exceed 10-15%. In this scenario, equipment imported in 2015 and before on high prices, could only be sold at a loss in the season 2016.

For many companies which already experienced difficulties with the working capital, it was a very unpleasant surprise. As a consequence, according to the results of 2016, there was a serious redistribution of the market shares in favor of those who were able to import big amounts of equipment at the new prices.

Turnover rate of funds became a critical issue in the situation of low margins. Until 2014, the average rate of profit allowed to operate successfully in a wholesale with the turnover rate of 1-1.3. It was possible to carry out the basic delivery of equipment at the beginning of the year, sell it with payment delayed and correct the warehouse slightly by the subsequent buying. Now such a scheme leads to losses in the most cases. The current margins force the companies to maintain the turnover rate at the level of 2. To do it, it’s necessary to minimize the amount at the warehouses, especially of slow-selling items, and to deliver equipment more evenly throughout the year. Ideally, the supplies should come every week in the period from February to July. But such a frequency of delivery can only afford a big company with a perfect logistics and extensive distribution network.

Results

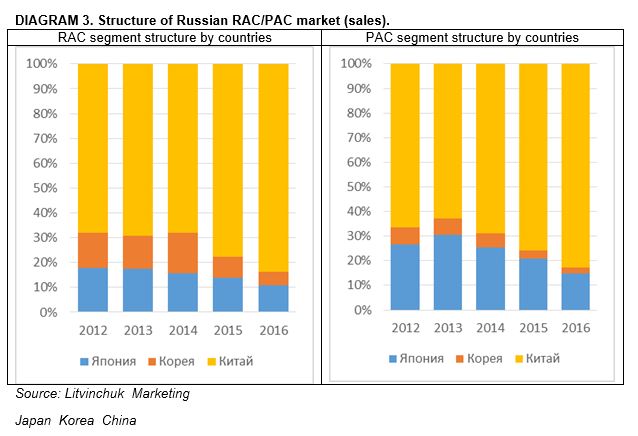

In 2016, the sales in quantitative terms were almost the same as the previous season. According to the preliminary data, approximately 1.3 million split systems of all types were sold (previous year - 1.33 million). In monetary terms, the results were much more modest. The drop was 34%! What was the reason for this disparity? At the Diagram 3 can be clearly seen the changes in the sale structure by the countries-manufacturers. In 2016, sales of the more expensive Japanese and Korean equipment fell down sharply, the share was halved in comparison with the pre-crisis year 2014! But the Chinese equipment, which became cheaper by 17-22% in 2016, took 85% of the market in the both home and semi-industrial segments by the end of the season.

Secondly, the RAC/PAC market dramatically changed structurally. If the sales in units of the wall split systems with capacity less than 5 kilowatts increased by 1% compared to 2015, the sales of much more expensive semi-industrial equipment fell down by 28% and of multi-split systems by 43%. Sales of the wall split systems with capacity above 5 kilowatts also reduced but modestly by 12%. This dynamics speaks clearly about the changing in the structure of the market in favor of the private clients. Corporate clients had to save money desperately in 2016, preferring the senior models of the wall split-systems to semi-industrial air conditioners, and tried to buy more cheap Chinese equipment instead of Japanese.

If analyzing the situation with the Japanese equipment, it can be found that in the PAC segment dominated the inexpensive inverter low-power models (up to 4 kW), which belonged to this segment exclusively because of the type of indoor unit. In the RAC segment, the economy-series inverter models and equipment at special prices had the biggest demand. Bestsellers of the previous years were sold rather sluggishly.

All mentioned above led to the drop of sales in value terms below the level of 2009.

Unclear prospects

Looking at the picture of shipments to Russia in 2016, Chinese manufacturers are determined to raise the prices of equipment to the previous level. They are sure that the crisis in Russia is over and it' s just the time to make money on our importers again. The immediate return to the price level of 2015 is unlikely, but all new equipment in the season 2017 would be offered at higher prices. We can guess that in these conditions, a number of Russian suppliers with the most solid financial resources would make the stock buying equipment at old prices. Therefore the delivery in November and December could be significantly higher than in previous years.

Volume of sales in 2017 is unlikely to be significantly lower than this year. If the summer 2016 had not been so warm, the market would have “tried the bottom” already this season, and in 2017 would show a slight increase. With the current development of situation, the market could hit a bottom (in units) in 2017, and then begin to grow slowly driven by the increasing volume of replacements. But in terms of money, the season 2016 is sure to be the worst in recent years. It is so, because in the next season, the inevitable increase in factory prices of Chinese manufacturers would compensate a possible reduction in sales.

The sales structure will be very close to the present one, except that Chinese products could win a further 2-3%.

Georgy Litvinchuk,

General Director of Litvinchuk - Marketing