Swing - 2017

The season of 2017 is sure to enter the history of the Russian air conditioning market as one of the most controversial. What can be said if in the early autumn, many market players find it difficult to sum up the results of this anomalously cold season. The season was marked by the May snowfalls, the growth of sales of the industrial HVAC equipment and the treacherous behavior of the Chinese partners raising prices for the equipment already paid and shamelessly disrupting delivery terms.

Everything started very well. In January-March, sales exceeded the results of 2016 one and a half times. There were several reasons for this flurry activity. First, the information that the Chinese manufacturers raised prices for equipment and the distributors would have to do the same, prompted the dealers to purchase. Second, many Chinese factories disrupted the shipment terms in January-April 2017, so, fearing a shortage of equipment as it happened in the high season of 2016, the dealers began to make a stock of equipment. And third, the weather contributed to the sales at the start of the season. After the abnormally warm February, the first month of spring turned out to be 3.4 ° C warmer than regularly in Moscow. This is very much. In other words, March in the capital delighted the locals with the weather more typical of Rostov-on-Don. The snow disappeared by the middle of March, almost four weeks earlier than usually.

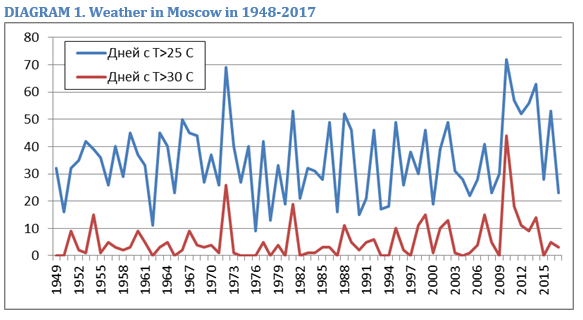

But then the “global warming” destroyed all expectations. If considering Moscow, the biggest market, in April the average monthly temperature turned out to be colder than the norm by 1.4 ° C, in May — by 2.3 ° C, in June — by 2.5 ° C, in July — by 1.3 ° C. And only in August the average temperature rose by 1.8 ° C above the norm. But it was too late to save the season.

The late spring and early summer with the snowfalls in May and somewhere in June, turned out to be the coolest for the last 15 years. Only in 2003 it was colder.

Unfortunately, the climatic anomaly covered not only Moscow. It was unusually cold almost in the whole European part of the country. Only in certain regions in the south of the country, the summer turned out to be warm: in the towns of Makhachkala, Stavropol, Kerch, Anapa and Sochi. In Rostov and Krasnodar, it was within the climatic norm, in Astrakhan and Simferopol a little bit cooler. Heat came in all these regions only in the middle of July, and therefore the season turned out to be spoiled.

It was hot only in Siberia, from Tomsk to Khabarovsk. But this region of the country consumes less than 10% of all equipment, and therefore could not save the situation. We can say with confidence that the resulting sales of 2017 will not exceed

Now many players expect good sales in November-December, since under the current macroeconomic situation there is a certainty that the budget purchases will be financed at least as good as at the end of 2016.

At the same time, if considering the segments of PAC and inverter air conditioners, despite the overall drop in sales by

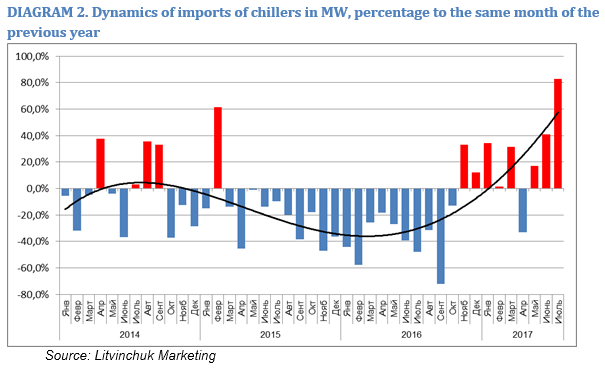

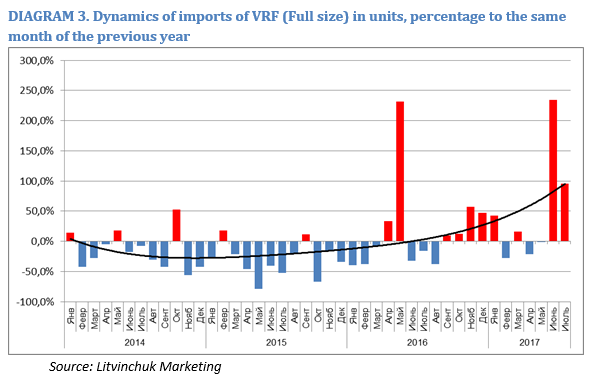

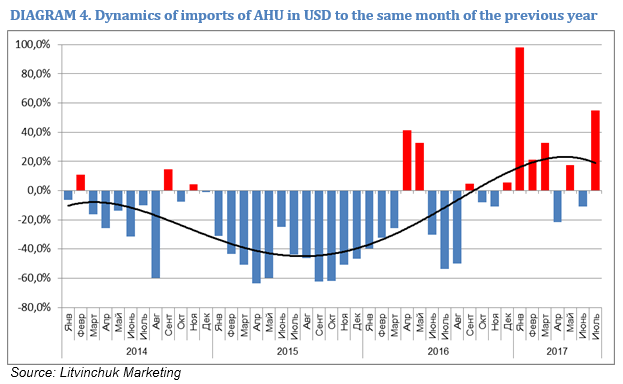

Even more evident is the dynamics of imports for such items as chillers, VRF and AHU. This equipment is actively used in the non-residential construction. From the Diagrams

Dynamics of the delivery of chillers and AHU is smoother than the VRF one. This can be explained by the greater capacity of the first two markets and by the fact that the chillers and AHU are being sold practically directly without storage in the warehouses, whereas some VRF importers practice a big one-time deliveries

Despite the positive dynamics in physical terms (units, kilowatts, cubic meters per hour), the situation in monetary terms in the market of industrial HVAC equipment does not look so nice. There are two reasons. The first is the growth of share of the more affordable equipment, Russian in the chiller segment and Chinese in the AHU segment. The second is the substitution of the chillers with screw compressors by the more accessible equipment with scroll compressors. In the first half of the year, import of the chillers with screw compressors fell by 13% in quantitative terms and by 25% in monetary terms. At the same time, import of the chillers with scroll compressors increased by 14% in quantitative and by 12% in monetary terms. Volume of sales of the refrigerating machines with the Turbocor type compressors more than doubled. That partly explains the failure of the screw compressors, but it is not the main and the sole reason.

As to the prospects for the development of the market of industrial HVAC equipment, in

Georgy Litvinchuk