Russian market of chillers in 2014

In this article were used the materials of APIC and the company

LITVINCHUK MARKETING

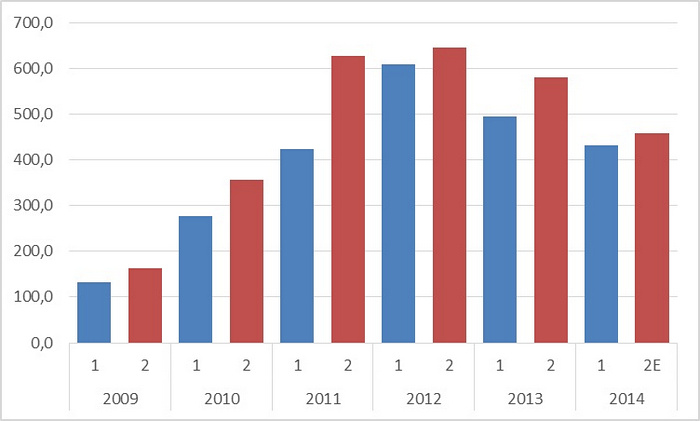

After the 2008 financial crisis, the Russian construction market recovered faster than analysts had expected. As a result, by the end of 2011, sales of chillers in Russia came to the pre-crisis level. Sales of 2012 excided the volume of 2008 by 4,0%. In 2013 the market continued to rise, however, the growth was a small, according to preliminary data about 4.4%, if we assume that in terms of power. In the first half of 2014 the import of chillers decreased by 12%. Proceeding from the less optimistic forecasts, the resulting DROP in sales by the end of the year could reach 16-18% (Diagram 1).

Figure 1: Dynamics of sales of chillers on the Russian market, by 6 months in MW.

Source: LITVINCHUK MARKETING

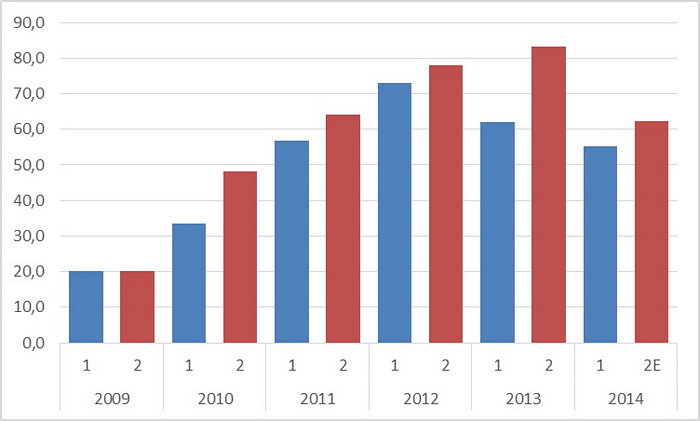

In the value terms ($ millions, dealer prices excluding VAT), the DROP is even more significant, about 25-27% (Figure 2).

Figure 2: Dynamics of sales of chillers on the Russian market, by 6 months in $ millions, dealer prices excluding VAT.

Source: LITVINCHUK MARKETING

Why has this imbalance formed? There are two reasons, but the both lie in the field of price. First, in the segment of high and medium power chillers the share of scroll multi-compressor chillers grows. Chillers of this type are cheaper than the same power screw chiller, to say nothing of the type Turbocor equipment.

Second, in 2013 the situation with the sales of different brands of chillers was greatly distorted by the Olympic construction. By 2012, the share of the Big Three (Carrier, Trane, York) was declining for several years running and DROP ped to 27.1% in value terms. In 2013, thanks to the Olympic construction, it jumped to 34.8% and in the first half of 2014 fell back almost to the previous level of 27.4%. At the same time, sales of inexpensive brands to the contrary increased substantially.

According to the results of the first half of 2014, the first place still holds Carrier with about 17% of the market. On the second place for the first time of the market existence appeared to be Daikin, with a share of 11%. (It would be wrong to explain this fact only by the stop of sales of equipment under the brand McQuay. In 2013, a joint share of Daikin and McQuay did not exceed 9.1%, and in 2012 – 9.6%). The next group is formed by Aermec, Rhoss, Trane, Clint, Clivet with a share from 7.1 to 5.5%. Speaking about he share of manufacturers, on the third position with a share of 10.3% would be KTK (brands Clint, NED, Korf).

As to the prospects of the market in the coming years, they do not look optimistic. In 2013, up to 60% of the total non-residential construction in Russia was carried out with the budget money (including the facilities of state-owned companies such as Gazprom, Sberbank, etc.). In 2014, the government sharply reduced investment in the construction industry because of the budget deficit, and economic sanctions caused investment problems for bid state-owned companies. As a result, in 2014, were started only few new facilities. A serious volume of the chillers sales in the first half of the year largely happened due to the unfinished construction started in 2012-2013.

In 2015 we expect a further decline in sales by 20-30% in value terms.

At the same time, the volume of old equipment replacement is very small. In 2000 the entire size of the market didn’t not exceed 150-170 MW. Therefore, currently not more than 10-15% of equipment go to replace old chillers, but in the coming years this segment of the market would grow rapidly due to market stagnation and aging of the fleet.

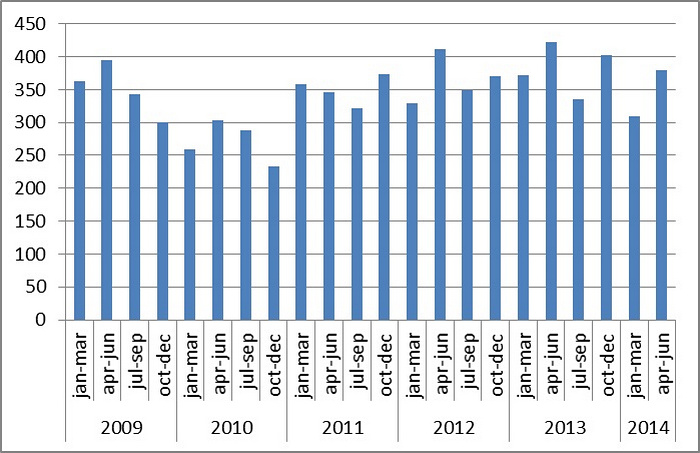

Figure 3: The average power of chiller in the Russian market by quarter 2009-2014.

Source: LITVINCHUK MARKETING

It should be noted that another trend has been broken. If starting from the end of 2010 to mid-2013 an increase in the average power of the chiller (Figure 3) could be seen, than from the third quarter of 2013 it turned down, and would continue to fall judging by the current trends. The reason is reducing the number of new large construction. It is logical, that in the first half of 2014 there was a DROP of sales (in money terms) first of all of absorption and centrifugal equipment, 27% and 48% respectively, compared to the same period of previous year.

Georgy Litvinchuk